What's up guys, welcome back to the channel. Today, I'm interviewing Sean. He actually has a really special job in the Air Force. So, this is the interview that you guys are going to stick around for the whole thing. Even after seven months in your bridge, that long? Yeah, dude, that's crazy. Something that I ask people to start on an interview is why did I join the Air Force. But you have a different story because you cross-trained from a maintenance job, yep, into pararescue. But I still think it's good to know what was your initial reasons for joining. Oh my gosh. So, I worked at Starbucks for like three years. I was a barista, whatever. All my buddies, they're like joining the Marine Corps. They're gonna be marines, will be grunts, whatever. And so, they all join. Act like six guys that throw in rank. Where I was like, I'm gonna do it too. So, I went there and the marine guy, like the shop was closed that day. I was like, I guess I'm just gonna go to the army. The army was trying to sell me on their job and I was like, I don't really want to do that. And I just so happened to walk with the Air Force guy who's reading it. He had his feet on the table. He's like reading a newspaper and knocked on the door. He's like, this is what I go daddy. Just make fun of us. Yeah, right. Because you sit in the chair, right? Hey, I'm locked the door. And he's like, dude, when I joined, I was like, yeah, I do. And so, we just started to sell me on what the Air Force was doing and what they offer and all that....

Award-winning PDF software

Af 422 notification of air force members qualification status Form: What You Should Know

AF Form 422 Notification of Air Force Member's Qualification Status; (United States of America) Form. The AF Form 422 must be on file in the Recruiting Service in order to assist active duty ARI Force members who, after application for an AF Form 422, have not yet been assigned to a unit but wish to meet the requirements by means of a notification sent to their home station. AF Form 417 — Notification of AF Member's Status Application Submission Deadline Application Submission Deadline to meet the Active Duty Air Force Medical Requirements (2018–18) to be confirmed to the active duty Air Force. This deadline is based on the date of application. Applicants who have applied for an AF Form 422 notification of Air Force member's qualifications status, and been told that a status review has been completed and approved (the AF Form 422 Notification of Air Force Member's Qualification Status has been modified), must submit their application/ notification. FEDERAL EDUCATION AND TRAINING ACT OF 1948 (Title 42, U.S.C.) Title IV of the Act, as amended, requires military medical training programs to implement policies to ensure that the training programs comply with minimum standards concerning the selection and retention of students who apply to participate in such programs. The standards for meeting the requirement for military medical training and education are described in section 813a of Title 10. Applicants must be required to undergo a complete medical exam. Any applicant for the following: 1. Active duty with a uniformed service that requires education as measured by a college or technical school designation for that service must be recommended for such appointment according to the standards described in the Federal Register, including section 812b of Title 10, or, if there is an inconsistency, the standard that is more stringent. These standards include: 1. Eligibility, 2. A physical examination, 3. A medical examination, 4. A psychological evaluation, 5. A personal interview, 6. Any other standardized examination that is necessary to verify the applicant's overall character, fitness, and suitability for assignment (or in the case of active duty service, the service requirement of a higher grade on the basis of the applicant in good standing), and 7. Evidence of proficiency in military medical knowledge, skills, and abilities appropriate for military service.

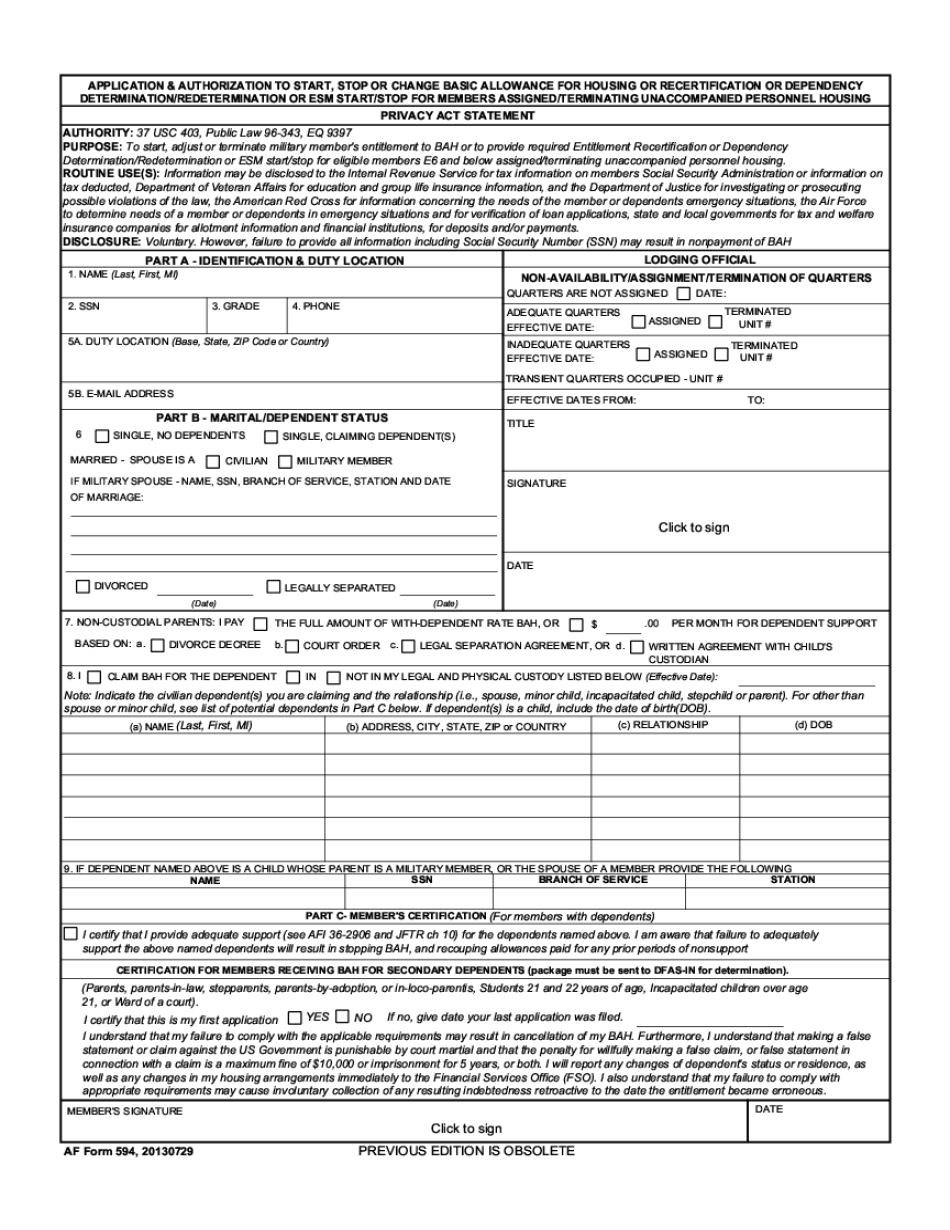

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Af Form 594, steer clear of blunders along with furnish it in a timely manner:

How to complete any Af Form 594 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Af Form 594 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Af Form 594 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Af form 422 notification of air force members qualification status